What is Trust Administration?

Trust administration is the process of managing and distributing the assets within a trust according to the terms set by the settlor (the person who created the trust) after their death or incapacitation. This process, often overseen by a successor trustee, ensures that the trust is executed as intended, benefiting the beneficiaries and maintaining the legal and tax responsibilities associated with it. Here’s a closer look at what trust administration involves, why it’s important, and how trustees can navigate the process effectively.

Why Trust Administration Matters

A trust is designed to ensure a smooth transfer of assets, avoid probate, minimize estate taxes, and provide privacy for the deceased’s estate. Trust administration is the backbone of this process. It ensures that the trust functions as planned, distributing assets as specified while adhering to legal, tax, and fiduciary obligations. Proper administration provides beneficiaries with clarity and assurance, maintaining the integrity of the trust.

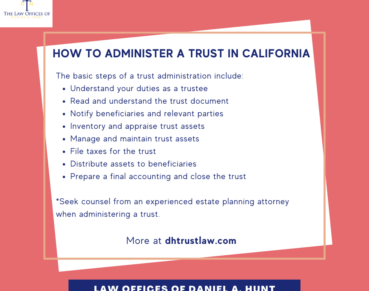

Key Steps in Trust Administration

What does a trust administration entail? Here are some of the key steps to administer a trust.

- Reading and Understanding the Trust

Before administering a trust, the trustee must obtain, read, and understand the settlor’s estate planning documents. They have a duty to administer the decedent’s estate according to the terms of the trust, and not in any other way. An experienced trust attorney can help you understand the trust and the trustee’s duties under the California Probate Code.

- Identifying and Organizing Trust Assets

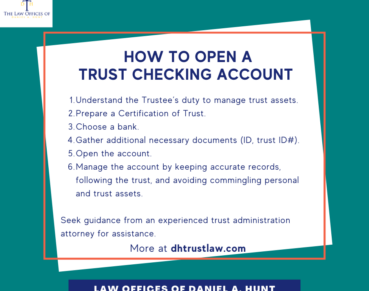

One of the trustee’s first responsibilities is to locate, identify, and value all assets in the trust. These can include bank accounts, real estate, investments, and personal property. Ensuring that all trust property is accounted for is crucial, as assets left outside the trust may not be protected and might require probate. - Communicating with Beneficiaries

Trustees are legally required to keep beneficiaries informed. They should communicate the trust’s existence, provide copies of the trust document if required, and update beneficiaries on the administration process. Clear communication builds trust and helps avoid misunderstandings. - Managing Trust Assets

The trustee has a fiduciary duty to manage assets prudently. This may involve managing investments, collecting income, paying debts, and handling expenses. Trustees must act in the best interests of the beneficiaries, exercising sound judgment, and avoiding personal gain. - Handling Debts, Taxes, and Expenses

A significant part of trust administration involves settling any outstanding debts and paying necessary taxes. The trustee must file the decedent’s final income tax return and potentially a federal estate tax return, depending on the estate’s size. It’s also important to ensure that trust expenses, such as legal and accounting fees, are handled promptly. - Distributing Trust Assets and Accounting to Trust Beneficiaries

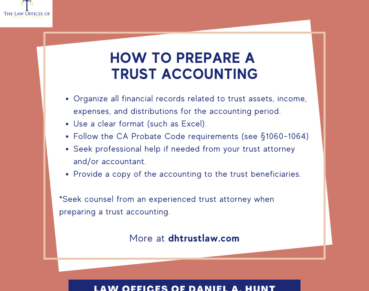

Once debts and expenses are paid, and taxes are resolved, the trustee can begin distributing assets to trust beneficiaries according to the trust terms. This distribution process should follow the trust’s instructions precisely. In some cases, distributions may be delayed if assets are not yet liquidated, or the trust mandates a phased distribution schedule. The Trustee also has a duty to provide an accounting to each beneficiary for the financial transactions of the trust made by the Trustee during the course of the trust administration.

Legal and Fiduciary Responsibilities of the Trustee

Under the California Probate Code, trustees carry legal and fiduciary duties and can be held liable if they mismanage the trust or fail to follow the law. Fiduciary duties require trustees to act in good faith, with loyalty, impartiality, and diligence.

It’s crucial for trustees to keep thorough records, document all transactions, and maintain transparency to protect themselves and serve the beneficiaries effectively. Trustees that breach their fiduciary duties may be held personally liable for any damages caused to the trust beneficiaries.

When Should a Trustee Seek Professional Guidance?

Trust administration can be complex, especially if the trust includes significant assets, unique investment interests, or complicated tax obligations. Trustees should seek counsel from an experienced trust administration attorney to ensure they fulfill their responsibilities, protect the trust’s integrity, and avoid potential pitfalls that could lead to legal or financial complications.

If you have questions about trust administration or need assistance with managing a trust, don’t hesitate to contact our law firm for a no-cost initial consultation.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.